Power in Numbers™ Shop

Ultimate Getting Ready for Taxes Bundle - DIY Tax Prep for Small Business Owners

Ultimate Getting Ready for Taxes Bundle - DIY Tax Prep for Small Business Owners

5.0 / 5.0

(2) 2 total reviews

Couldn't load pickup availability

Are your numbers a mess?

Despite your best intentions, maybe you didn’t keep up with all of your numbers throughout the year…and now you are scrambling to figure out what you need to do to get it all together in time.

Or maybe this is your FIRST year filing taxes as a self-employed individual, and you feel clueless as to what you need to do to stay out of trouble with the IRS AND get all those tax deductions you deserve?

Financial Expert and CPA Jamie Trull gets it. As someone who has worked with THOUSANDS of small business owners, she can confirm that you are NOT ALONE.

The Ultimate Getting Ready for Taxes Bundle is EXACTLY what you need right now.

Instead of days or even weeks...you could be done in mere HOURS from now.

That means getting precious time back to use on more important things...like growing your business (or binging Vampire Diaries on Netflix).

Your time and sanity are priceless.

And believe it or not, you can easily become your own ultimate tax service, without paying for expensive professional tax software or unnecessary preparation fees to tax professionals.

We'll show you everything you need to know that trained tax preparers know.

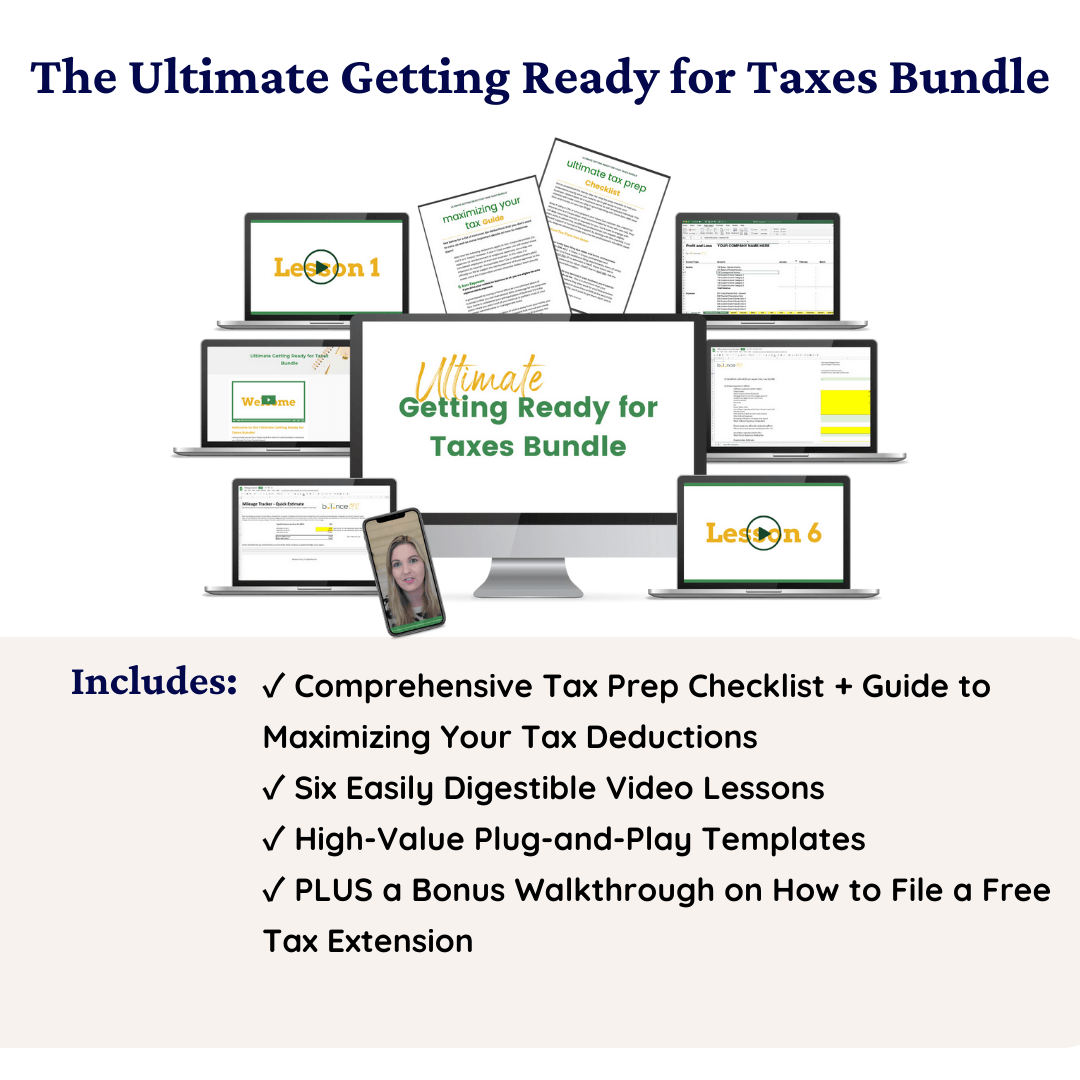

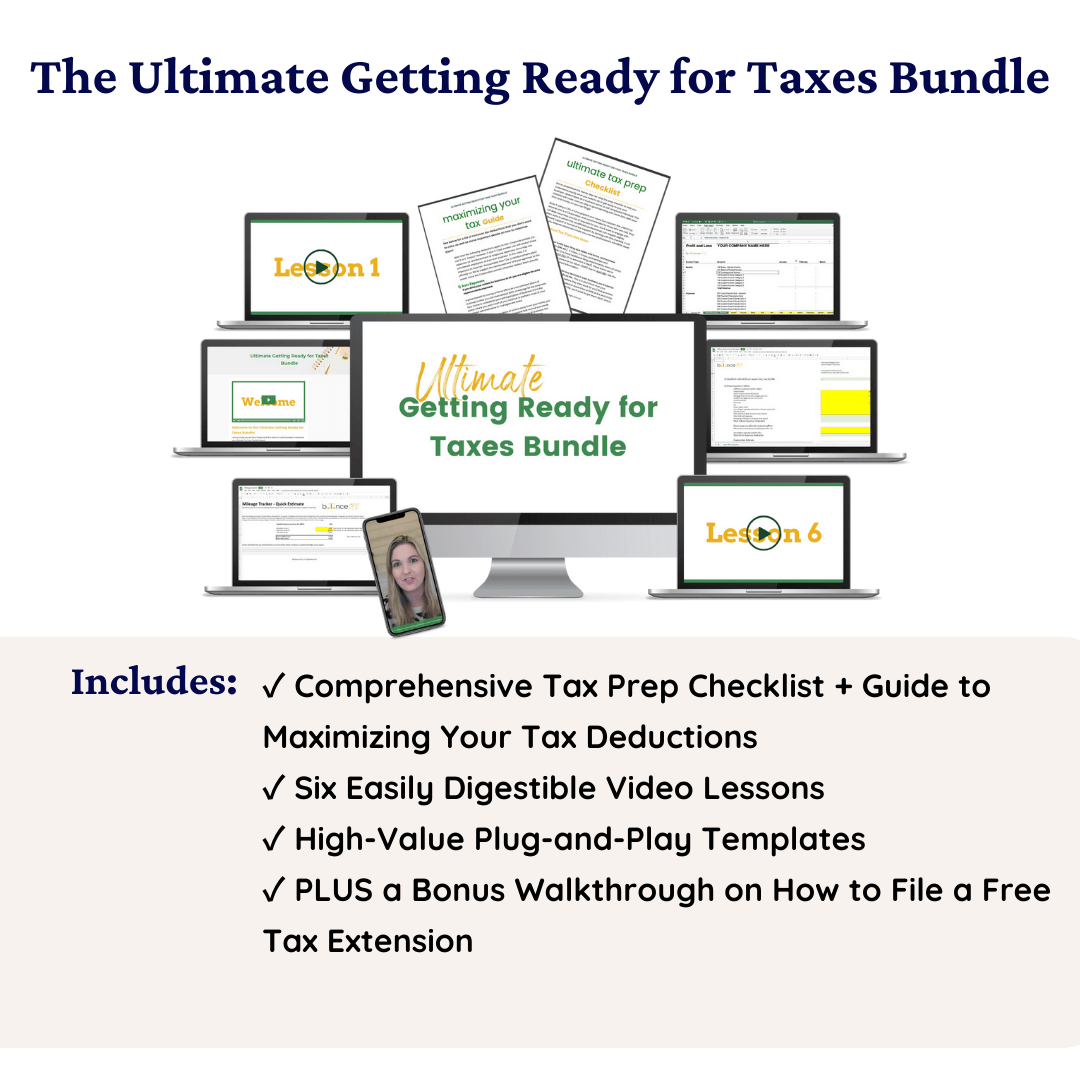

Here's what's included in the Ultimate Tax Bundle for business owners

A Comprehensive Tax Prep Checklist and a Guide to Maximizing Your Tax Deductions

The Tax Prep checklist walks you through what you need to do and when as you get your tax information together for your business.

The Guide to Maximizing Your Tax Deductions gives you a list of key tax deductions, along with some strategies to maximize your deductions.

In these resources you'll find:

✓ All the important tax deadlines

✓ What information you need to pull together and how to do it in a flash

✓ A list of some of the commonly missed tax deductions and how to maximize your tax savings

✓ Steps you can take to make tax time even easier next year

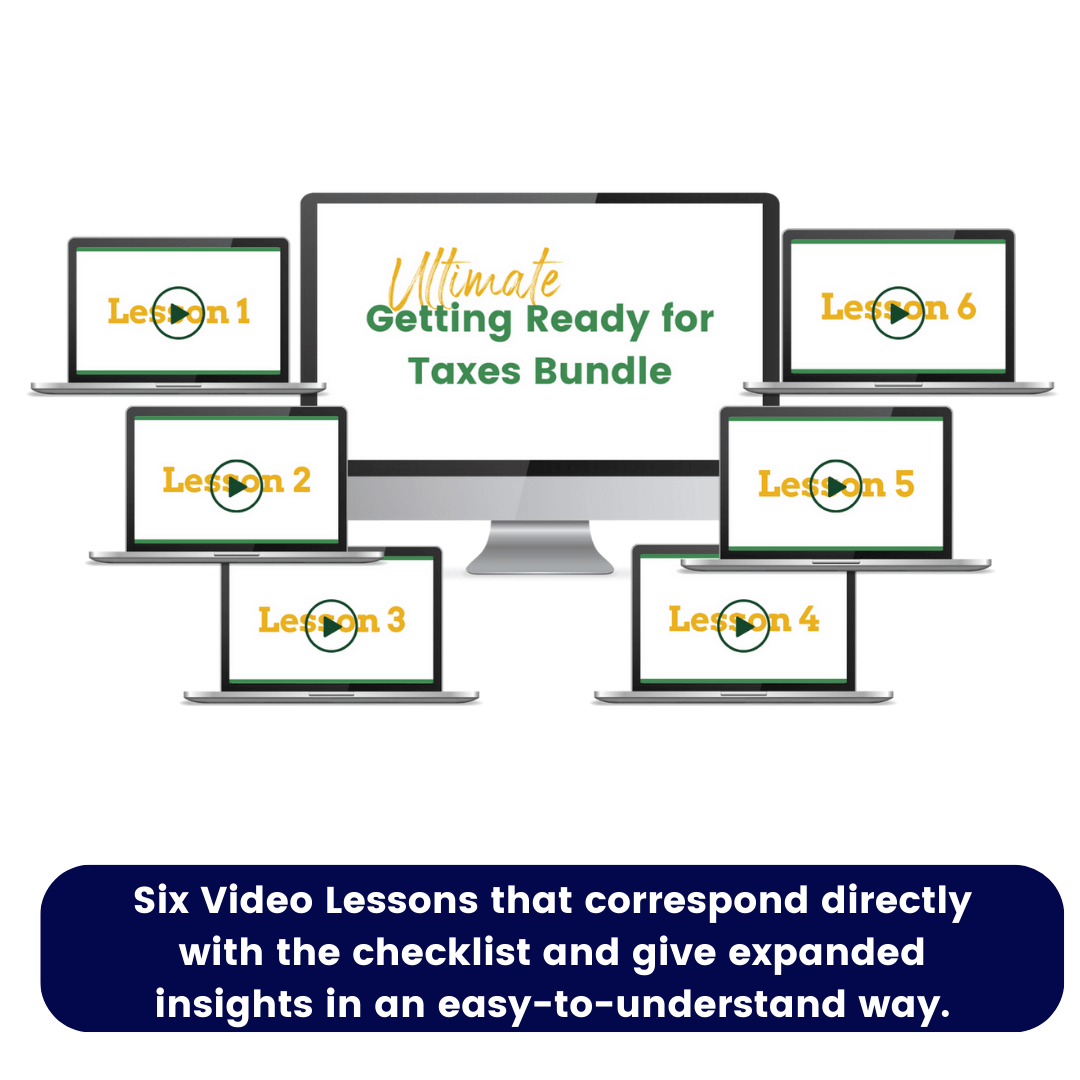

Six Video Lessons

These video lessons correspond directly with the checklist and give expanded insights in an easy-to-understand way.

What does it include:

✓ Short informative lessons that won't make you doze off

✓ Some key shortcuts you can take when pulling your numbers together

✓ A deeper dive into some common questions, like how and when you need to issue 1099s

✓ A discussion of commonly missed deductions, including deductions for home-based businesses, auto usage, and more.

✓ PLUS a Bonus Walkthrough on How to File a Free Tax Extension

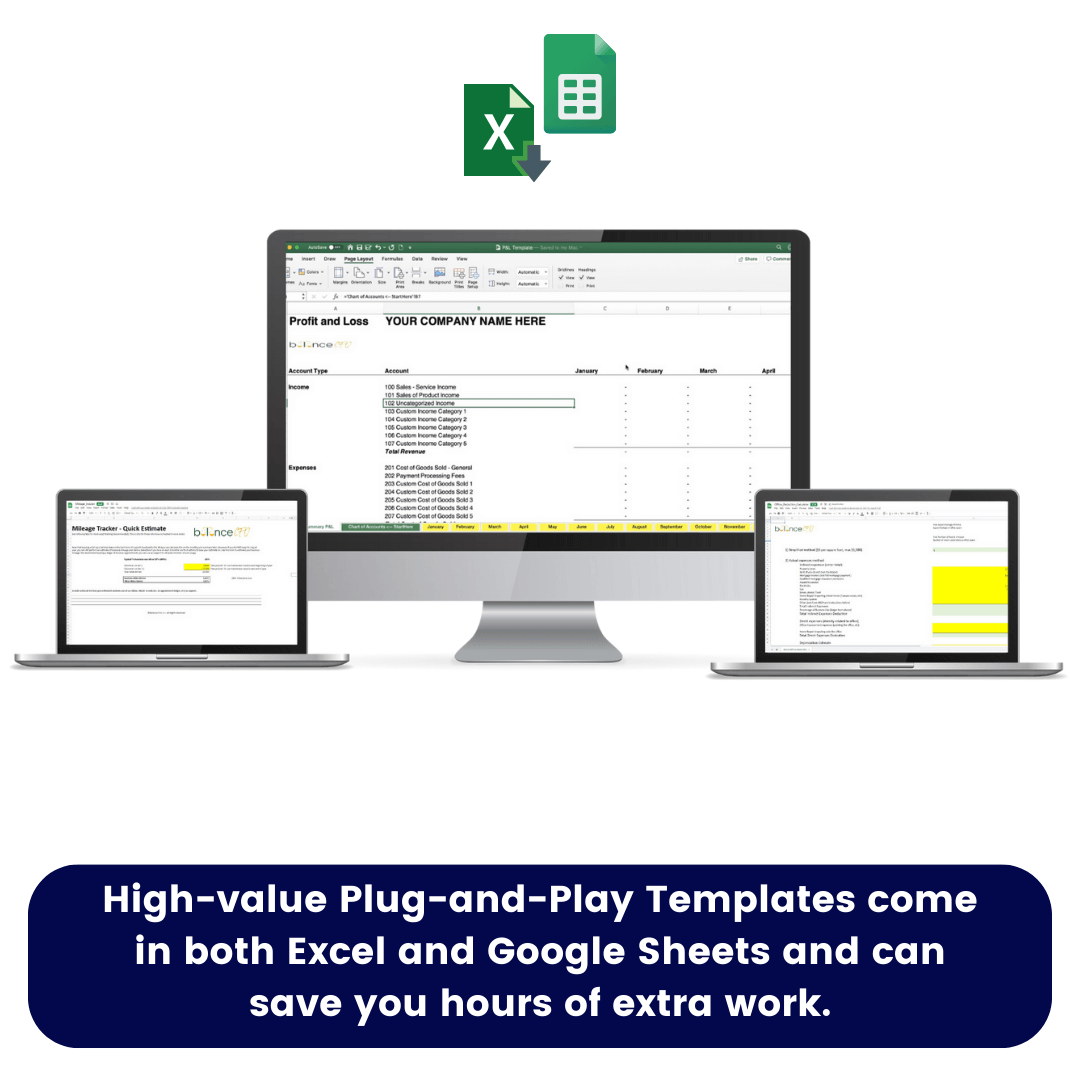

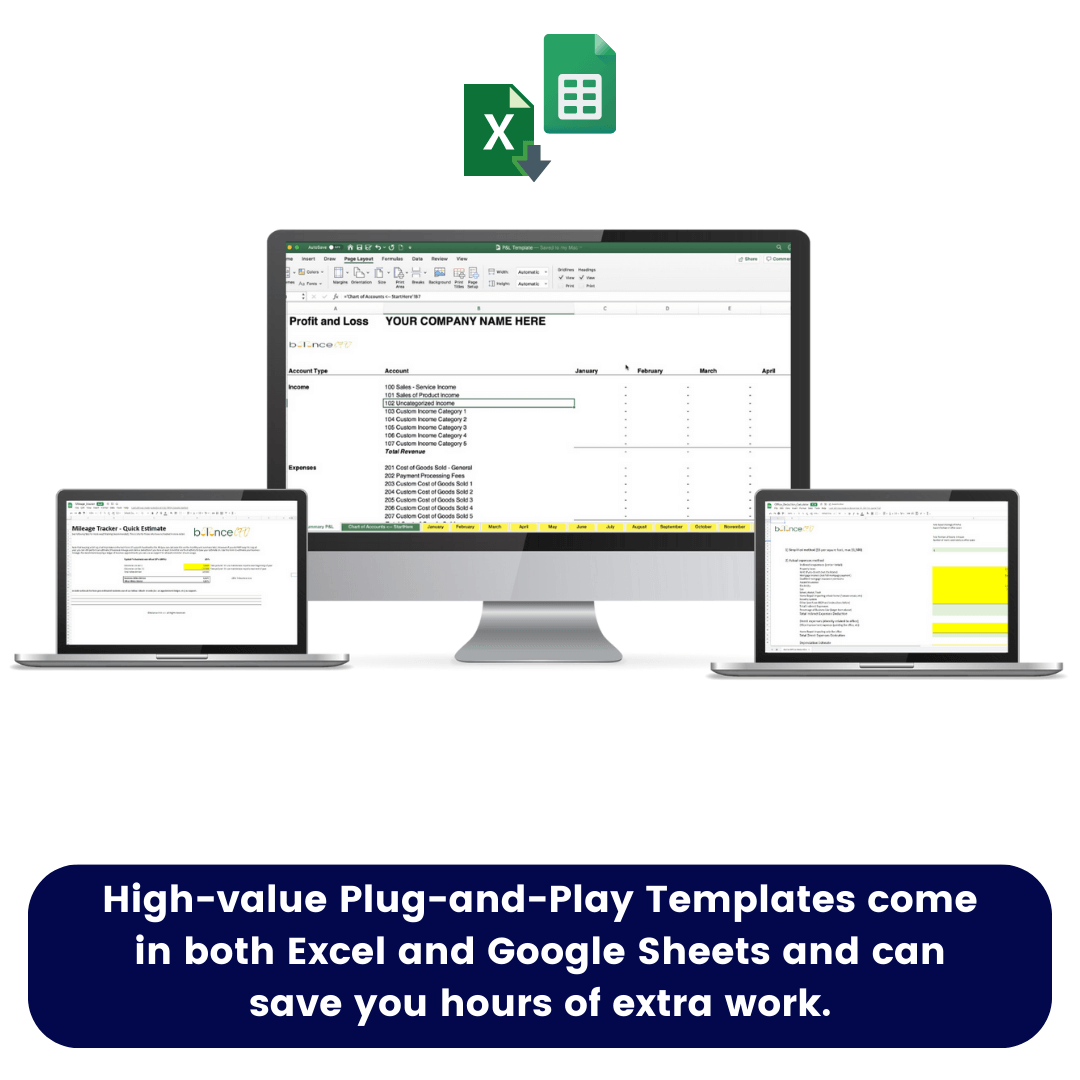

Plug-and-Play Templates

These high-value templates come in both Excel and Google Sheets and can save you hours of extra work

What does it include:

✓ A Profit and Loss Template to help you create a P&L on the fly without the need for expensive software

✓ A mileage tracker to help you track miles all year long, or estimate them if you didn't track all year.

✓ A Home Office Deduction Maximizer Calculator that will help you make sure to get the most out of your tax savings

Frequently Asked Questions

Your access to this content DOES NOT EXPIRE! If we ever change platforms or stop offering this content, you’ll be given plenty of notice to download the materials you want to save.

Looking for an even deeper dive into your business finances?

Share

No more hours of searching in google, youtube or making calls spending $$$ in bookeppers and advice from CPA's. Here you'll fine the basics and real important things !... more if you are not familiar with the taxes system in this country. Highly reccomended

We're truly grateful for your positive feedback. We're pleased to hear that our content has been valuable, especially for those navigating the tax system in this country for the first time.

If you're feeling at all stressed about how to handle your taxes as a small business owner, you NEED this course! Jamie covers all the bases in a way that's accessible and easy to understand even if you've never taken any sort of finance course before.

Thank you for the wonderful feedback! We're delighted to hear that our tax bundle was able to alleviate some of the stress associated with handling taxes for small business owners.