Why is Financial Tracking Important for Self-Employed Individuals?

Being self-employed comes with many benefits, such as flexible working hours and the ability to be your own boss. However, it also means taking on additional responsibilities, including managing your finances. Financial tracking is crucial for self-employed individuals as it allows them to keep a close eye on their income, expenses, and overall financial health.

How Can Affordable Financial Tracking Help Self-Employed Individuals?

For self-employed individuals, every penny counts. That's why it's essential to find an affordable financial tracking solution that meets their needs. With the right tools, self-employed individuals can:

- Track income and expenses: An affordable financial tracking solution enables self-employed individuals to easily record and categorize their income and expenses. This helps them understand where their money is coming from and where it's going.

- Generate financial reports: Financial reports provide valuable insights into the financial health of a self-employed individual's business. An affordable financial tracking solution can generate reports such as profit and loss statements, balance sheets, and cash flow statements.

- Stay organized: Keeping track of invoices, receipts, and other financial documents can be overwhelming for self-employed individuals. An affordable financial tracking solution can help them stay organized by storing and organizing all their financial information in one place.

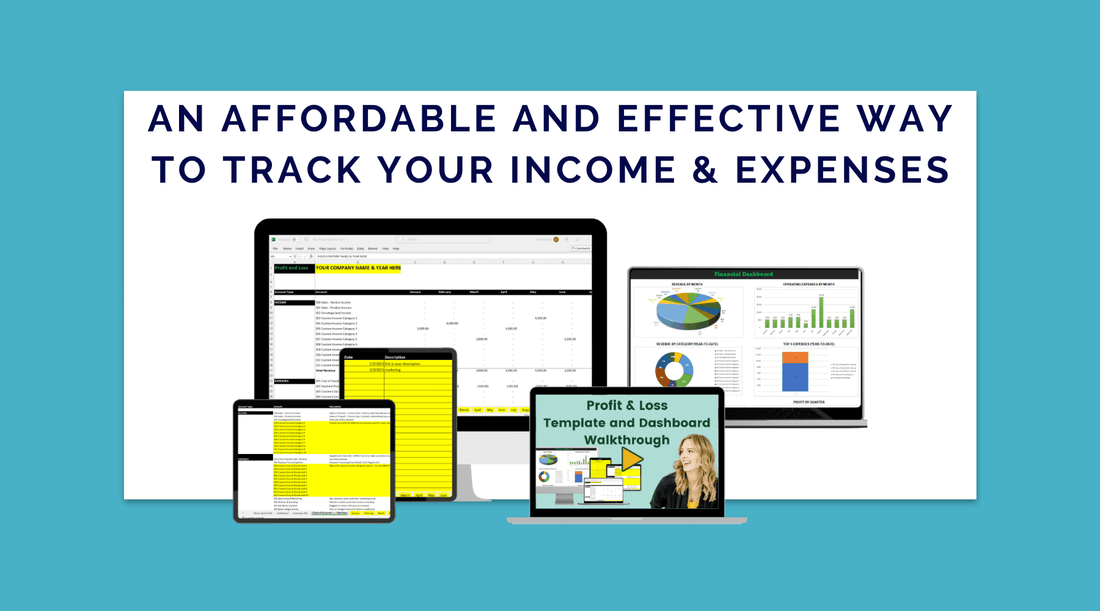

Introducing the Profit and Loss Statement Template For Small Businesses

One affordable financial tracking solution that is perfect for self-employed individuals is the Profit and Loss Statement Template For Small Businesses. This template is designed specifically for self-employed individuals who want to track their income and expenses effectively.

With the Profit and Loss Statement Template For Small Businesses, self-employed individuals can easily input their income and expenses and generate a comprehensive profit and loss statement. This statement provides a clear overview of their business's financial performance, allowing them to make informed decisions and identify areas for improvement.

Why Choose the Profit and Loss Statement Template For Small Businesses?

There are several reasons why the Profit and Loss Statement Template For Small Businesses is the ideal financial tracking solution for self-employed individuals:

- Affordability: The template is priced at an affordable rate, making it accessible to self-employed individuals on a tight budget.

- User-friendly: The template is easy to use, even for individuals with limited accounting knowledge. It comes with clear instructions and pre-built formulas, making financial tracking a breeze.

- Customizable: The template can be customized to suit the specific needs of each self-employed individual. They can add or remove categories, modify formulas, and personalize the design.

- Comprehensive: The Profit and Loss Statement Template For Small Businesses provides a comprehensive overview of a self-employed individual's financial performance. It includes sections for income, expenses, gross profit, net profit, and more.

Start Tracking Your Finances Today!

If you're a self-employed individual looking for an affordable and effective financial tracking solution, look no further than the Profit and Loss Statement Template For Small Businesses. Take control of your finances and make informed decisions to grow your business.

Don't miss out on this opportunity! Purchase the Profit and Loss Statement Template For Small Businesses now by clicking here.